On behalf of the entire IPG Board of Directors, we look forward to seeing you at the meeting.

Our Board of Directors is soliciting proxies from our stockholders in connection with our annual meeting of stockholders to be held on Tuesday, May 31, 2011June 3, 2014 and at any and all adjournments thereof. No business can be conducted at the annual meeting unless a majority of all outstanding shares entitled to vote are either present in person or represented by proxy at the meeting. As far as we know, the only matters to be brought before the annual meeting are those referred to in this proxy statement. If any additional matters are presented at the annual meeting, the persons named as proxies may vote your shares in their discretion.

any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent registered public accounting firm and our management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, including the fees for the services performed to date. In addition, the Audit Committee also may pre-approve particular services on acase-by-case basis, as required.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF DELOITTE & TOUCHE LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2011

INFORMATION REGARDING EXECUTIVES

EXECUTIVE OFFICERS

The following table sets forth certain information regarding our executive officers as of March 31, 2011.April 1, 2014.

|

| | | | |

| Name | | Age | | | | |

Name

| | Age

| | Position |

|

| Valentin P. Gapontsev, Ph.D. | | | 72 | 75 | | Chief Executive Officer and Chairman of the Board |

| Eugene Scherbakov, Ph.D. | | | 63 | 66 | | Managing Director of IPG Laser GmbH, Senior Vice President, Europe and Director |

| Timothy P.V. Mammen | | | 41 | 44 | | Chief Financial Officer and Senior Vice President |

| Angelo P. Lopresti | | | 47 | 50 | | General Counsel, Secretary and Senior Vice President |

| Alexander Ovtchinnikov, Ph.D. | | | 5053 | | | Senior Vice President-ComponentsPresident, Components |

George H. BuAbbud, Ph.D. Trevor D. Ness | | | 5641 | | | Senior Vice President-Telecommunications ProductsPresident, World Wide Sales |

| Igor Samartsev | | | 4851 | | | Acting General Manager of NTO IRE-PolusChief Technology Officer and Director |

William S. ShinerFelix Stukalin | | | 6952 | | | Senior Vice President-Industrial MarketsPresident, U.S. Operations |

The biographies of Dr. Gapontsev, Dr. Scherbakov and Mr. Samartsev are presented on Page 9.page 10. The biographies of our other executive officers are presented below.

Timothy P.V. Mammenhas served as our Chief Financial Officer since July 2000 and a Vice President since November 2000. He was promoted to Senior Vice President in February 2013. Between May 1999 and July 2000, Mr. Mammen served as the Group Finance Director and General Manager of the United Kingdom operations for IPFD. Mr. Mammen was Finance Director and General Manager of United Partners Plc, a commodities trading firm, from 1995 to 1999 and prior to that he worked in the finance department of E.I. du Pont de Nemours and Company. Mr. Mammen holds an Upper Second B.Sc. Honours degree in International Trade and Development from the London School of Economics and Political Science andScience. Also, he is a Chartered Accountant and a member of the Institute of Chartered Accountants of Scotland.

Angelo P. Loprestihas served as our General Counsel and Secretary and one of our Vice Presidents since February 2001. He was promoted to Senior Vice President in February 2013. Prior to joining us, Mr. Lopresti was a partner at the law firm of Winston & Strawn LLP from 1999 to 2001. Prior to that, he was a partner at the law firm of Hertzog, Calamari & Gleason from 1998 to 1999 and an associate there from 1991 to 1998. Mr. Lopresti holds a B.A. in Economics from Trinity College and a J.D. from the New York University School of Law.

Alexander Ovtchinnikov, Ph.D.,has served as our Vice President, Components, since September 2005 and as Director of Material Sciences from October 2001 to September 2005. He was promoted to Senior Vice President in February 2013. Prior to joining us, Dr. Ovtchinnikov was Material Science Manager of Lasertel, Inc., a maker of high-power semiconductor lasers, from 1999 to 2001. For 15 years prior to joining Lasertel, Inc., he worked on the development and commercialization of high power diode pump technology at the Ioffe Institute, Tampere University of Technology, Coherent, Inc. and Spectra-Physics Corporation. He holds an M.S. in Electrical Engineering from the Electrotechnical University of St. Petersburg, Russia, and a Ph.D. from Ioffe Institute of the Russian Academy of Sciences.

Trevor D. Ness has served as our Senior Vice President, World Wide Sales since February 2013. From January 2011 until February 2013, he served as our Vice President–Asian Operations. Prior to joining us, he was Director of GSI Precision Technologies China from May 2005 to December 2010. Mr. Ness holds a B.S. in Geology from Imperial College, a H.N.C. from Bournemouth University and an M.B.A. from The Open University.

George H. BuAbbud, Ph.D.,Felix Stukalin has served as our Senior Vice President, U.S. Operations since February 2013. From March 2009 until February 2013, he served as our Vice President, Telecommunications Products, since July 2002.Devices. Prior to joining us, Dr. BuAbbudhe was Vice President, Business Development of GSI Group Inc. from April 2002 to September 2008, and Chief Technical Officer forfrom March 2000 to April 2002 he was Vice President of Components and President of the Access Network Systems divisionWave Precision divisions of Marconi Communications, Inc., a maker of telecommunications systems, from

20

1999 to 2002. HeGSI Lumonics, Mr. Stukalin holds a B.E.B.S. in Electrical Engineering from the American University of Beirut and an M.Sc. and a Ph.D. in ElectricalMechanical Engineering from the University of Nebraska.

William S. Shinerhas served as our Vice President-Industrial Markets since March 2007Rochester and as Directorhe is a graduate of Industrial Markets since August 2002. Prior to joining us, Mr. Shiner was Vice President of Sales and Marketing for Coherent Industrial from 1980 to 1995 and Chief Operating Officer for Convergent Prima from 1995 to 2002. Mr. Shiner holds a B.S.E.E. and an M.B.A. from Northeastern University.the Harvard Business School General Management Program.

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board of Directors has reviewed and discussed with management the Compensation Discussion and Analysis included in this proxy statement. Based on this review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s proxy statement for the Company’s 20112014 annual meeting of stockholders.stockholders and in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013.

COMPENSATION COMMITTEE

Robert A. Blair,Chair

William S. Hurley

William F. Krupke, Ph.D.John R. Peeler

March 23, 2011

21

EXECUTIVE COMPENSATIONApril 1, 2014

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis

In this section, we describe the material components of our executive compensation program for our “Named Executive Officers” whose compensation is set forth in the Summary Compensation Table and other compensation tables contained in this proxy statement:

| | |

| • | Valentin P. Gapontsev, Ph.D., our Chairman and Chief Executive Officer; |

|

| • | Timothy P.V. Mammen, our Vice President and Chief Financial Officer; |

|

| • | Eugene Scherbakov, Ph.D., the Managing Director of IPG Laser GmbH, our subsidiary; |

|

| • | Angelo P. Lopresti, our Vice President, General Counsel and Secretary; and |

|

| • | Alexander Ovtchinnikov, Ph.D., our Vice President of Components. |

We also provide an overview provides a comprehensive review of our executive compensation philosophy and program, including our executiveprogram design for fiscal year 2013. The discussion in this section focuses on the compensation program. In addition, we explain how and why the Compensation Committee of our Board arrives at specific compensation policies“Named Executive Officers” or “NEOs” for fiscal year 2013, who were:

Valentin P. Gapontsev, Ph.D., our Chairman and decisions involving the Named Executive Officers.

Executive Summary

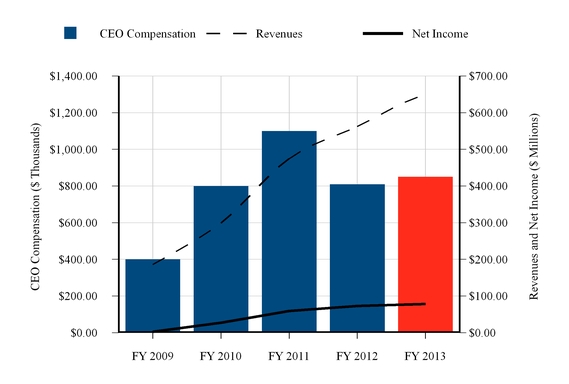

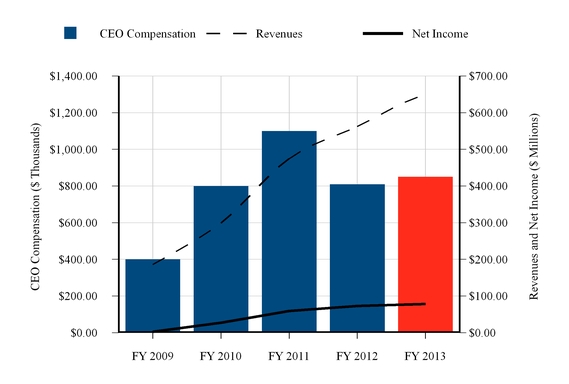

We seek to pay for performance and we believe our record for the past five years shows that we have accomplished this goal.

2010 Financial Highlights. Total 2010 revenues grew 61% from 2009 to $299.3 million and we ended the year with record backlog. Annual gross margins improved to 48.9% from 34.6%. Net income increased to $54.0 million in 2010 from $5.4 million in 2009, and earnings per share rose to $1.13 from $0.12. We also generated $63 million of cash from operations in 2010 and ended the year with a strong balance sheet.

The following graphs show our annual revenue and net income during the last five fiscal years:

The description above is only a summary. For more complete information about our financial performance, please review the Company’s Annual Report onForm 10-K for the year ended December 31, 2010 filed with the SEC on March 15, 2011.

2010 Executive Compensation Highlights. In 2010, 63% of our Named Executive Officers’ compensation on average was delivered in the form of variable annual cash incentives and long-term equity incentives. For our Chief Executive Officer, 55%Officer;

Timothy P.V. Mammen, our Senior Vice President and Chief Financial Officer;

Eugene Scherbakov, Ph.D., the Managing Director of his compensation for 2010 was delivered in variable annual cash incentivesIPG Laser GmbH, our subsidiary, and he received no equity awards in 2010. Base salaries for the Named Executive Officers in 2010 were maintained at the same level as 2009 (except for one officer). In 2009, the Company’s Named ExecutiveSenior Vice President, Europe;

22

Officers took voluntary salary reductionsAngelo P. Lopresti, our Senior Vice President, General Counsel and no variable annual cash incentives were awarded toSecretary; and

Alexander Ovtchinnikov, Ph.D., our Named Executive Officers because the Company did not meet the targets in the 2009 short-term cash incentive plan.Senior Vice President, Components.

2010 Corporate Governance Highlights. We endeavor to maintain good governance standards including with respect to the oversight of our executive compensation policies and practices. Under the direction of the Compensation Committee, the following policies and practices were in effect during 2010:

| | |

| • | IPG has only one-year employment agreements for executives, except for the Chief Executive Officer, who has a two-year employment agreement; |

|

| • | no supplemental executive retirement plans (SERPs) or other nonqualified plans for executives; |

|

| • | no single-trigger change in control payments; |

|

| • | no taxgross-up payments for change in control payments under Code Section 280G; |

|

| • | no taxgross-up payments for executive perquisites (which are minimal, in any event); |

|

| • | no severance payments for Cause terminations or resignations other than for Good Reason; |

|

| • | no perquisites for former or retired executives; |

|

| • | no extraordinary relocation or home buyout benefits; |

|

| • | no personal use of corporate aircraft, personal security systems maintenanceand/or installation or executive life insurance; |

|

| • | there are limits on award payouts under our annualshort-term cash incentive plan; |

|

| • | stock ownership guidelines are in place for our executive officers and directors; and |

|

| • | only the Compensation Committee may approve equity grants. |

Additionally, IPG made improvements to certain elements of our executive compensation programs to further align them with current good governance standards, including adopting a prohibition on executive officers and directors engaging in hedging transactions.

The Compensation Committee meets the independence standards of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”). The Compensation Committee is advised by an independent compensation consultant, Radford, which is retained directly by and reports to the Compensation Committee, and which performs no other work for IPG without the express approval of the Committee. The compensation consultant had no prior relationship with our Chief Executive Officer or any other executive officer. The Compensation Committee meets without management present at least four times per year.

Compensation Program Objectives and Principles

We believe that our success depends on the continued contributions of our executive officers. Our executive compensation programs are designed with the philosophy of attracting, motivating and retaining experienced and qualified executive officers and recognizing individual merit and overall business results.

The objectives of our compensation programs are to:

attract and retain talented and experienced executives;

| | |

| • | attract and retain talented and experienced executives; |

|

| • | motivate and reward executives whose knowledge, skills and performance are critical to achieving strategic business objectives; |

|

| • | align the interests of our executive officers and stockholders by motivating executive officers to increase long-term stockholder value; |

|

| • | incentivize future performance through both short-term and long-term financial incentives to build a sustainable company and foster the creation of stockholder value; and |

|

| • | foster a shared commitment among executives through establishment of uniform company goals. |

23

motivate and reward executives whose knowledge, skills and performance are critical to achieving strategic business objectives;

In order to be effective, we believe our executive compensation program should meet the needs of the Company, our employees and our long-term stockholders. Our policies are also intended to support the attainment of our strategic objectives by tyingalign the interests of our executive officers and stockholders by motivating executive officers to increase long-term stockholder value;

provide incentives for future performance through both short-term and long-term financial incentives to build a sustainable company and foster the creation of stockholder value; and

foster a shared commitment among executives through establishment of uniform company goals.

Our compensation philosophy is reflected in the following executive compensation design principles:

In addition to a competitive base salary, a substantial portion of the executives’ potential cash compensation should be tied to a short-term incentive plan that rewards corporate and individual achievement of challenging performance goals; and

The Company uses a combination of restricted stock units and stock options with thosea service-based vesting to provide a combination of retention and motivation to increase the value of the Company’s common stock.

|

| | |

Compensation Element | | Objective |

| Base salary | | Provide a competitive fixed component of cash compensation. |

Short-term incentive plan | | Offer a variable cash compensation opportunity earned based upon the level of achievement of challenging corporate goals, with additional compensation opportunity based upon individual performance. |

Long-term incentives | | Align long-term management and stockholder interests and strengthen retention with four-year vesting provisions. Service-based equity awards offer certainty and long-term retention while providing additional compensation opportunity to executives based upon increased stock price levels. |

| Benefit plans | | Provide competitive employee benefits. We do not view this as a significant component of our executive compensation program. |

2013 Business Highlights

IPG continued its revenue and income growth in 2013, finishing another record year. We reported revenue growth in all four quarters and continued to make investments for the future. Our results demonstrated that IPG extended its competitive lead while capitalizing on the growing demand for fiber laser technology.

Our strong performance is largely attributable to factors specific to the Company, such as our market leadership in high-power fiber lasers for materials processing applications. IPG achieved greater sales of high-power, medium-power and quasi-CW lasers used in cutting and welding applications. A growing number of OEM customers have developed cutting systems that use our high-power lasers and sales of these systems are gaining sales from gas laser systems. In addition, new welding processes using fiber lasers have been developed, increasing sales of lasers for this application which are replacing traditional laser and non-laser welding technologies. We also introduced new products and applications, assisted by our ongoing significant investments. While we did not grow at the same rate as in 2012, our sales in 2013 grew at a 15% rate over the prior year.

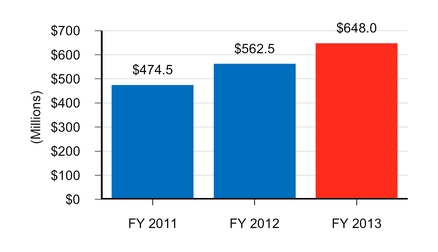

The Company recorded $648 million in revenues in 2013, which is the highest level of revenues for any fiscal year in our history.

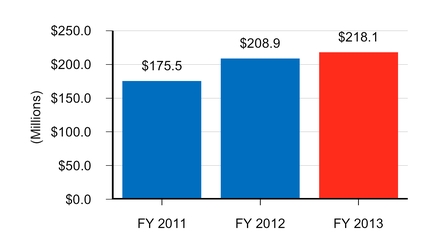

Our operating income also achieved its highest levels to date, reaching $218 million in 2013 compared to $208 million in 2012 and $176 million in 2011.

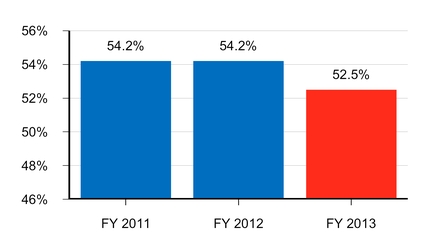

Our gross margin decreased to 52.5% in 2013 from 54.2% in 2012, but represented industry-leading gross margins as compared to our laser peers.

The Company also increased its cash and cash equivalents to over $448 million at December 31, 2013, reflecting solid operating cash flows. Also, we continued substantial investments during 2013 in property, plant, equipment, technology and people so that we are well-positioned for future demand growth for our industry-leading products.

For more information about our business, please read “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K filed with the SEC on February 28, 2014.

Pay-for-Performance

We structure our executive compensation program so that a meaningful percentage of compensation is tied to the achievement of high levels of Company performance. The payouts under our 2013 short-term incentive program reflect the Company’s strong financial and strategic performance. We use net sales and earnings before interest, as adjusted for certain items (“adjusted EBIT”), as the key performance metrics in our compensation program as we believe that they reflect a number of important competitive and business elements, such as product acceptance and revenue growth, and profitability, and are therefore excellent barometers of our overall performance. For 2013, our net sales and adjusted EBIT were $648 million and $231 million, respectively, both of which were higher than the levels from 2013, but below the target levels of $666 million and $250 million, respectively, that the Compensation Committee set for the year. These targets were set such that achievement of the targets would have required record-setting performance by the Company.

Our 2013 annual short-term incentive plan was structured to pay out 100% of our CEO’s base salary and 67% of the other executives’ base salaries if (i) the Company successfully achieved both target levels of financial performance and (ii) the executives achieved the highest levels of individual performance. Based on the Company’s 2013 net sales, adjusted EBIT and individual performance levels (as further described under “Components of Compensation in 2013 – Short-Term Incentive Plan” below), our 2013 short-term incentive plan paid bonuses equal to approximately 84% of our Chief Executive Officer’s base salary and 56% of the other Named Executive Officers’ base salaries.

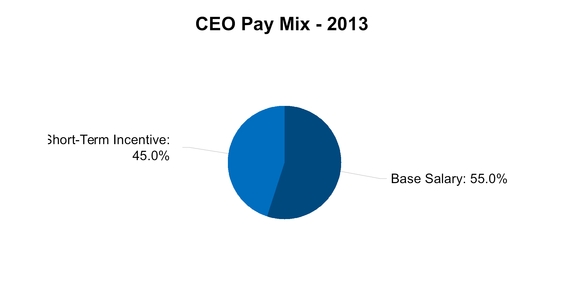

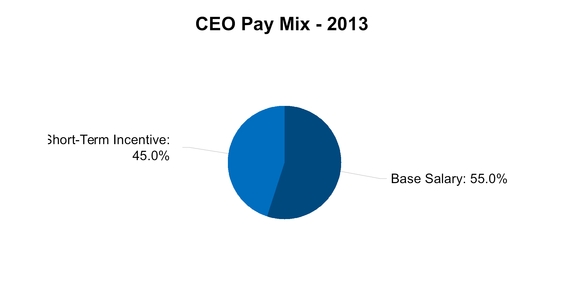

To illustrate our pay-for-performance philosophy, the following charts reflect the portions of our executive officers’ actual compensation for 2013 represented by each of the major elements of our compensation program – base salary paid, 2013 short-term cash incentives (at actual amount earned), option awards and restricted stock units with service-based vesting criteria (valued at their grant-date fair value):

A significant majority of the executives’ overall compensation is derived from performance-based or long-term stockholders throughservice-based components of our program. In 2013, this included 45% of the Chief Executive Officer’s compensation and 65% of the other Named Executive Officers’ compensation.

Our Chief Executive Officer, Dr. Valentin Gapontsev, is also the Company's founder. He does not receive long-term incentives in the form of equity or cash because of his significant level of ownership of our common stock. As a result, a smaller percentage of his total compensation is performance-based as compared to the chief executives of our peer companies, who receive additional compensation in the form of long-term incentives. Dr. Gapontsev's compensation is substantially below the compensation of chief executive officers at our peer companies. Also, his compensation over the past five fiscal years further reflects the effectiveness of our pay-for-performance program. The Company’s operating results over the past five years have resulted in corresponding levels of Chief Executive Officer compensation. Conversely, in fiscal year 2009, when the global economic downturn significantly impaired our financial results, Dr. Gapontsev received only his base salary for that year as no bonus was earned based on the Company’s results, notwithstanding management’s effectiveness during that challenging period in maintaining the employee and operational performance goalscustomer bases so that we were well-positioned to take advantage of the subsequent demand recovery. The following table demonstrates our pay-for-performance model by tracking Dr. Gapontsev’s actual total compensation in each of the last five fiscal years against Company revenues and equity-based compensation.net income:

How Executive Compensation is Determined

Role of the Compensation Committee. The Compensation Committee determines, approves and administers the compensation ofprograms for our executive officers, including our Named Executive Officers. Our Compensation Committee is also responsible for making recommendations to the Board with respect to the adoption of stockequity plans and certain other benefit plans. The Compensation Committee may delegate authority whenever it deems appropriate, but it did not do so in 2010.

2013.

Our Compensation Committee’s policy is to set executive officer pay in accordance with the objectives of the Company’s compensation programs as described above. In our view, the Company’s executive compensation program provides an overall level of compensation opportunity that is competitive with other companies in the laser source and photonics industry, as well as with a broader group of technology companies of comparable size and complexity that have similar growth rates and international scope.peer companies. Actual compensation levels may be greater or less than median compensation levels provided by similar companies based upon annual and long-term Company performance, as well as individual performance, contributions, skills, experience and responsibilities.

During 2010,2013, the Compensation Committee was comprised of three independent directors at all times. Mr. Blair, Chair, Mr. Hurley and Dr. KrupkeMr. Peeler served on the Committee for the entire year. Mr. GauthierMichael Kampfe served on the Compensation Committee until June 2010 and Mr. Hurley served on2013 when he left the Committee from and after June 2010.Board. Mr. Blair has chaired the Committee since 2006.

Role of Executive Officers in Compensation Decisions. The Compensation Committee regularly meets with Dr. Gapontsev, our Chief Executive Officer, to obtain recommendations with respect to the compensation programs, practices and packages for our Named Executive Officers. Additionally, Mr. Mammen, our Chief Financial Officer, and Mr. Lopresti, our General Counsel, are regularly invited to meetings of the Compensation Committee or otherwise asked to assist the Committee. Such assistance includes providing financial and compensation information and analysis for the Compensation Committee and its compensation consultant, taking minutes of the meeting or providing legal advice, developing compensation proposals for consideration, and providing insights regarding our employees (executive and otherwise). The Named Executive Officers attend portions of Compensation Committee meetings when requested, but leave the meetings as appropriate when matters that will potentially affect them personally or other executive officers including the Chief Executive Officer are discussed. ManySeveral meetings of the Compensation Committee are not attended by management. From time to time, outside legal counsel and the compensation consultant attend Compensation Committee meetings. The Compensation Committee makes decisions regarding Dr. Gapontsev’s compensation without him present. From time to time, outside legal counsel and the independent compensation consultant attend Compensation Committee meetings.

Role of Compensation Consultant. The Compensation Committee engaged Radford, an independent compensation consultant, to conduct a comprehensive review and analysis of our executive compensation program and to make recommendations in 2009 and 2010.for compensation related to 2013. The compensation consultant provides the Compensation Committee with an independent evaluation of executive compensation and is available as needed by the Compensation Committee to provide advice and counsel. Radford serves at the discretion of the Compensation Committee. Neither Radford nor Aon, Radford’s parent company, does any other work for the Company. Aon is a global provider of many services relevant to the Company’s business and the Company may retain other services from Radford or Aon as appropriate. The Compensation Committee has reviewed the independence of Radford in light of SEC rules and NASDAQ listing standards regarding compensation consultants. The Compensation Committee believes that there are no actual or potential conflicts of interest.interest with Radford in 2013. The Compensation Committee authorizes the compensation consultant to confer with management for perspective on the impact of compensation recommendations.

Pay Positioning Strategy

We strive to positionIn 2013, we positioned the midpoint of the Company’s target total cash compensation rangesrange near the 50th65thpercentile and the long-term incentive range near the 50th percentile of the target compensation of our peer group, resulting in targeted total compensation that is competitive within our labor market for performance that meets the objectives established by the Compensation Committee. An individual’s actual salary, non-equity incentive compensation opportunity and equity compensation may fall below or above the target position based on the individual’s experience, seniority, skills, knowledge,

24

performance and contributions as well as the Company’s performance. These factors are weighed individually by the Compensation Committee in its judgment, and no single factor takes precedence over others nor is any formula used in making these decisions. The Chief Executive Officer’s review of the performance of his direct reports is carefully considered by the Compensation Committee in making individual compensation decisions.

In analyzing our executive compensation program relative to this target market positioning, the Compensation Committee utilizes a comparative analysis of the compensation of our executive officers measured against a group of industry peer companies selected by the Compensation Committee with the assistance of Radford and management input. For 2010,The peer companies are companies in the laser source and photonics industry, peersas well as a broader group of technology companies of comparable size and complexity that have similar growth rates and international scope. Several factors were considered in selecting the peer group used in 2013, the most important of which were:

comparable business (primarily laser, photonics, semiconductor, optical components and related device companies);

market capitalizations, annual revenue and employee levels; and

geographic location.

Radford also supplements its peer analysis with the data from a broader list of high-technology public company participants in the Radford 2012 Global Technology Survey having revenue levels from $300 million to $1 billion.

For 2013, the peer companies were:

|

| | | | |

| • II-VI Incorporated | | • Analogic Corporation | | • Brooks Automation, Inc. |

| • Chart Industries, Inc. | | • Cognex Corporation |

| • Coherent, Inc. | |

| • Cymer Inc. | | • Electro Scientific Industries,Diodes, Inc. | | • Entegris, Inc. |

• Evergreen Solar Inc. FEI Company | | • EXFO Electro-Optical EngineeringFLIR Systems, Inc. | | • FEI CompanyGraco, Inc. |

• FormFactor, Inc. | | • Hittite Microwave Corporation | | • Measurement Specialties,MKS Instruments, Inc. |

| • Newport Corporation | |

• Opnext,RBC Bearings, Inc. | | • Rofin-Sinar Technologies Inc. | | • Riverbed Technology, Inc. |

• Varian Semiconductor Equipment AssociatesTeradyne, Inc. | | • Veeco Instruments Inc. | | |

The Compensation Committee reviews this peer group annually to ensure that the comparisons are meaningful. Several factorsGiven the continuing rapid growth of the Company, the Compensation Committee undertook a review of our historical peer group for the 2013 compensation analysis, applying the criteria above. In this review, the Compensation Committee conducted an analysis of our peers to determine which companies are frequently referenced and whether they should be considered for inclusion in IPG Photonics’ peer group. Based upon this review, the Compensation Committee removed companies that were considered in selectingno longer viable peers due to acquisitions or that have financial profiles which are not well-aligned with ours. Added were Chart Industries, Inc., FLIR Systems, Inc., Graco, Inc., RBC Bearings, Inc., Riverbed Technology, Inc. and Teradyne, Inc. Removed were Acme Packet, Inc., Electro Scientific Industries, Inc., Measurement Specialties, Inc. and Opnext, Inc.

Also, the Compensation Committee conducted a review of peer companies for the 2014 compensation analysis. Based upon this review and applying the criteria above, the Compensation Committee removed Cymer Inc. from the peer group for 2010, the most important of which were:

| | |

| • | industry (primarily laser, photonics, semiconductor, optical components and related device companies); and |

|

| • | revenue and employee levels (primarily companies with between $180 million and $600 million in annual revenues, and between 300 and 2,200 employees). |

The Compensation Committee believes that companies that meet these criteria are our most likely competitors for executive talent in our labor markets. Radford also supplements its peer analysis with the data from participants2014 because it was acquired in the Radford High Technology Survey having annual revenue between $100 million and $400 million.

prior year.

Components of Compensation in 2010

2013

The principal components of our executive officer compensation during 2010 were:2013 were base salary, short-term cash incentives, long-term equity-basedequity incentive awards, severance benefits, retirement savings benefits provided under a 401(k) plan, and executive perquisites, and benefit programs generally available to other employees.

25

These components were selected because the Compensation Committee believes that a combination of salary, incentive pay, severance and retirement savings benefits and perquisites is necessary to help us attract and retain the executive talent on which our success depends. The annual cash incentives are designed to allow the Compensation Committee to reward performance over a fiscal year and to provide an incentive for executives to appropriately balance their focus on short-term and long-term strategic goals. The fixed components, including salary, severance and retirement savings benefits and perquisites, are structured to provide a sufficient level of compensation for our executives relative to theirday-to-day spending needsboth immediate and long-term needs for income.income needs. The Compensation Committee believes that, when taken together, these components are effective in achieving the objectives of our compensation program and philosophy and are reasonable relative to our strategy of managing total compensation near the 50th percentile of market practices.

practices targeted by the Compensation Committee.

The Compensation Committee annually reviews the entire compensation program with the assistance of its independent compensation consultant and outside legal counsel. However, the Compensation Committee may at

any time review one or more components as necessary or appropriate to ensure such components remain competitive and appropriately designed to reward performance. In setting compensation levels for a particular Named Executive Officer, the Committee considers both individual (as described above) and corporate factors.

In 2010, 63% of our Named Executive Officers’ compensation on average was delivered in the form of variable annual cash incentives and long-term equity incentives. The average pay mix for our Named Executive Officers during 2010 can be illustrated as follows:

Average Named Executive Officer Pay Mix in 2010

Note: The short term cash incentives represent actual awards for 2010 under our 2010 Short Term Incentive Plan. The long term incentives include stock options (based on the dollar amount recognized for financial statement reporting purposes for 2010 in accordance with ASC 718) and restricted stock units (using the grant date value). This chart does not include other benefits, such as perquisites

Base Salary. We provide base salary to our Named Executive Officers and other employees to compensate them for services rendered on aday-to-day basis during the fiscal year. Unlike short-term cash incentives and long-term equity incentives, base salary is not subject to performance risk. The Compensation Committee reviews information provided by its compensation consultant and considers the experience, skills, knowledge and responsibilities of the executive and the individual’s performance assessment provided by the Chief Executive Officer to assist it in evaluating base salary for each Named Executive Officer. With respect to the Chief Executive Officer, the Compensation Committee additionally considers the performance of the Company as a whole.

Based uponIn 2013, the information provided byCompensation Committee conducted an assessment of base salaries and total cash compensation for the Named Executive Officers. After consulting with its compensation consultant, the Compensation Committee did not approve anyincreased the targets for base salary and total cash compensation to the 65thpercentile of market practices, taking into account the increasing scale and complexity of the Company’s operations, the strong performance of the Company, the rapid growth of the Company and the importance of retaining an experienced team of proven executives. Based upon this and the selection of new peers for 2013, the Compensation Committee approved increases of 15% to the base salaries of the Named Executive Officers, except for Dr. Ovtchinnikov who received an increase in base salary of 20%. For 2014, the Compensation Committee appoved merit increases for 2010of 3% to the base salaries of the Named Executive Officers from 2013 levels, except that Mr. Mammen's base salary was increased by 5% to bring it in line with the levels set by the Compensation Committee in December 2008. However, Dr. Ovtchinnikov received a 9% merit increase in December 2009.market 65th percentile of our peer group.

26

Short-Term Cash Incentives.Incentive Plan. To focus each executive officer on the importance of the performance of the Company, a significant portion of the individual’s potential short-term compensation is in the form of annual cash incentive pay that is tied to the achievement of goals established by the Compensation Committee.

Our Named Executive Officers participate in our Senior Executive Short-Term Incentive Plan (the “STIP”). The STIP is administered by the Compensation Committee, which has the discretion to determine the type of award, whether cash or non-cash, granted under the STIP. The emphasis of the STIP is onemphasizes company-wide performance goals in order to foster a shared commitment among executives. Generally, award levels for executives are the same percentage of salary, except for the Chief Executive Officer who generally receives awardswhose target award is at a greater percentage of salary than the other officers for achievement of the same performance goals. The Compensation Committee determines who is eligible to receive awards under the STIP, establishes performance goals and objectives for executives, establishes target awards for each participant for the relevant performance period, and determines whatthe percentage of the target award that should be allocated to the achievement of each of the chosen performance targetsgoals in consultation with the Chief Executive Officer with respect to other executive officers. The target award percentages established by the Compensation Committee are chosen based upon a compensation review conducted by Radford and the seniority level of the executive.

In 2010,For 2013, the Compensation Committee identified two financial performance measures,measures: net sales and earnings before interest and taxesadjusted EBIT (excluding equity-based compensation expenses and expenses for budgetedapproved litigation matters in excess of budgeted amounts)matters), each as determined under the STIP, and assigned a 50% weighting factor to each financial performance measure.goal. The Compensation Committee chose to focus on revenue growth and pretax profits so that our executive officers would be incentivized to deliver the types of growth that benefit our stockholders, namely increasing sales and profitability.profits.

Upon the achievement of the objectives for each performance measure determined by the Compensation Committee, theThe Chief Executive Officer could receive a cash incentive payment ranging from 14%18.8% to 84%112.5% of his base salary, and other participants in the STIP could receive a cash incentive payment ranging from 9%12.5% to 56%75.0% of their respective base salaries, based upon achievement of the minimum to maximum objectives for both financial performance measures. If the financial performance exceeds one or more of the maximum objectives, the incentive payments to the executive would increase as determined by linear interpolation, subject to limits on payouts discussed below. The financial objectives were the same for all executive officers. The range of possible payout amounts for 2010 under the STIP for achievement of financial objectives for each Named Executive Officer is shown below and disclosed in the Grants of Plan-Based Awards table below. Consistent with ourpay-for-performance philosophy, no cash incentive payments would be made if the minimum financial objectives established by the Compensation Committee in 20102013 were not met.

While objectives were intended to be achievable by the Company, a maximum bonus would require very high levels of Company performance. The Compensation Committee believes that the goals are reasonably difficult to achieve, as demonstrated by the fact that the Company had never before 2010 achieved only the maximum targets since the STIP was adopted.payout once. The Compensation Committee set minimum and maximum targets for net sales of $214$566 million and $243$766 million, respectively, representing annual growth levels of 15%1% to 28%36% from the prior year. The minimum and maximum targets for earnings before interest and taxesadjusted EBIT were set from $34$200 million to $47$300 million, representing changesa change ranging from 160%a

decrease of 1% to 260%an increase of 38% from the prior year.

year, reflecting the effect of the substantial investment in plant and equipment in 2013. The Company’s record financial performancetarget levels for 2010 substantially exceeded the maximum targets set by the Compensation Committee. The Company achieved net sales of $299 million and earnings before interest and taxes of $79 million. These results represented a 61% increase in net sales and a 920% increase in earnings before interestadjusted EBIT were $666 million and taxes in 2009. The Compensation Committee awarded the Chief Executive Officer a cash incentive payment equal to 150% of his base salary, and the other Named Executive Officers cash incentive payments equal to 100% of their respective base salaries, which were the maximum possible payouts permitted under the 2010 STIP.

$250 million, respectively.

The Chief Executive Officer and the other Named Executive Officers were also eligible in 2010 under the STIP to receive awards of up to 19%25.0% and up to 13%16.7%, respectively, of their respective base salaries respectively,under the STIP in 2013, based upon their respective individual performance.performances. The individual goals and objectives for the Chief Executive Officer included additional financial measures, operational and strategic targets. Becausetargets set by the Compensation Committee with input from the independent directors.

The overall target award limits were reached solely based upon(including both financial performance measures, noand individual performance awardsmeasures) for the Chief Executive Officer was 100.0% of his base salary and 66.7% of the respective base salaries for the other participants. The financial objectives were approved in 2010.the same for all executive officers. The

27

awards range of possible payout amounts for 2013 under the STIP for 2010 are set forthachievement of financial objectives for each Named Executive Officer is shown below in the “Non-Equity Incentive Plan Compensation” columnGrants of Plan-Based Awards table. The maximum possible payouts under the Summary Compensation Table below.

The Compensation Committee targets total cash compensation (base salary plus short-term cash incentives) near the 50th percentileSTIP for both financial and individual performance measures are 225.0% of the target compensation of our peer group. In 2010, total cash compensation targetsaward for the Named Executive Officers was aligned on average withOfficers.

The Company’s record financial performance for 2013 exceeded minimum financial performance targets set by the lower end of the range of the 50th percentileCompensation Committee but did not reach either of the target compensationperformance measures. The Company achieved net sales of $648 million and adjusted EBIT of $231 million. These results represented a 15% increase in net sales and a 6% increase in adjusted EBIT over 2012 levels. The Compensation Committee reviewed the peer group.Chief Executive Officer’s goals and objectives set by the Compensation Committee with input from the independent directors and determined to award him 25.0% of his base salary for his individual performance during 2013. Also, the Compensation Committee, based with input from the Chief Executive Officer, awarded the other Named Executive Officers 16.7% of their respective base salaries for their individual performances in 2013.

The Compensation Committee may make adjustments to our overall corporate performance goals and the ways that our actual performance results are calculated that may cause differences between the numbers used for our performance goals and the numbers reported in our financial statements. These adjustments may exclude all or a portion of both the positive or negative effect of external events that are outside the control of our executives. The Compensation Committee made no adjustments to the 2013 STIP for amortization related to an acquisition in 2010.2013 and certain litigation expenses.

Based upon the Company’s financial performance and the individual performance of the Named Executive Officers, the Compensation Committee made the following 2013 awards:

|

| | | | | | |

| 2013 Short-Term Incentive Plan Payouts |

| Name | | Target Awards ($)(1) | | Actual Awards ($) |

| Valentin P. Gapontsev, Ph.D. | | 542,800 |

| | 445,894 |

|

| Timothy P.V. Mammen | | 261,224 |

| | 219,402 |

|

| Eugene Scherbakov, Ph.D. | | 299,092 |

| | 246,462 |

|

| Angelo P. Lopresti | | 249,321 |

| | 209,405 |

|

| Alexander Ovtchinnikov, Ph.D. | | 242,401 |

| | 203,593 |

|

| |

| (1) | Target Awards include both financial and individual performance targets. |

Long-Term Equity-Based Incentives. The goal of our equity-based award program is to provide employees and executives with the perspective of an owner with a long-term financial stake in theour success, of IPG, further increasing alignment with stockholders. Long-term incentive awards also incent employees to stay with us for longer periods of time, which in turn provides us with greater stability and directly links compensation to the long-term performance of the Company. In addition, these awards are less costly to us in the short-term than cash compensation. We review long-term equity incentives for our Named Executive Officers and other executives annually.

For our Named Executive Officers, our equity-based award program is based on annual grants. We have traditionally usedgrants of service-based stock options as equity compensation becauseand restricted stock units. Of the equity-based awards, 75% is typically in the form of stock options provide a relatively straightforward incentive for our executives. In 2010, the Compensation Committee conducted an analysis of types of equity awards granted by the peer group. Over a majority of the companiesand 25% is typically in the peer groupform of restricted stock units. Consistent with our pay-for-performance philosophy, the service-based stock option awards have no value unless our stock price increases after the grant restricted shares ordate and the value of the restricted stock units to their respective executives. Based upon this analysis, the Committee determined to substitute restricted stock units for a portion of the annual equity compensation grantsis tied to the Named Executive Officers, withvalue of our stock.

Since the same vesting terms at stock options,Company’s initial public offering in part so as to diversify2006, the equity incentives we provide. Historically, our Chief Executive Officer hasdid not received annual grants of stock options or restricted stock units because, asreceive any equity compensation awards. As the Company’s founder and holderthe beneficial owner of a large number of our shares, he has the perspective of an owner with a significant financial stake in the Company’s success.

In 2010, the Chief Executive Officer received no equity grant.

In 2010,2013, the Compensation Committee targeted granting equity compensation atnear the 50th percentile of the target compensation of our peer group, balancing the perspective of delivering competitive compensation based upon Black-Scholes option pricing values and as a percentage of the Company. TheseThe Compensation Committee analyzed several aspects of the equity grant program, including (i) the “in the money” value, the degree to which executives have incentives to remain employed by the Company through unvested option values, and (ii) the aggregate equity usage in terms of (a) annual usage, typically called burn rate, and (b) cumulative equity delivery, typically called overhang, to determine the dilutive effect of equity awards on investors. The majority of outstanding equity holdings of the executives (other than Dr. Gapontsev) were allocated to unvested shares in the aggregate, and all such executives had a minimum of four years’ worth of annual award values in unvested equity value. Based upon this information, Radford advised the Compensation Committee that our equity program provides strong retention incentives.

The following table shows grants of service-based stock options and restricted stock units to the Named Executive Officers in 2013:

|

| | | | | | |

| 2013 Long-Term Equity-Based Incentive Grants |

| Name | | Service-Based Stock Options (#) | | Service-Based Restricted Stock Units (#) |

| Valentin P. Gapontsev, Ph.D. | | — |

| | — |

|

| Timothy P.V. Mammen | | 14,200 |

| | 2,200 |

|

| Eugene Scherbakov, Ph.D. | | 13,000 |

| | 2,000 |

|

| Angelo P. Lopresti | | 11,000 |

| | 1,800 |

|

| Alexander Ovtchinnikov, Ph.D. | | 12,000 |

| | 1,900 |

|

Consistent with past practice as explained above, the Chief Executive Officer did not receive any equity-based award in 2013. The equity awards in 2013 vest fromin one installment four to five years after the grant date(March 1, 2017), and provide a strong incentive for executives to remain with the Companyemployed by us and to focus on increasing theour financial performance over the long term.long-term. The stock options awarded to the executives in 2013 have an exercise price of $60.11 per share.

Stock OptionEquity Grant Process. In 2007, the The Compensation Committee adopted an equity grant policy as follows:

| | |

| • | only the Compensation Committee has the authority to approve equity grants; |

|

| • | grants made by the Compensation Committee occur only after discussion at a meeting of the Compensation Committee; |

|

| • | equity award grants ordinarily are made by the Compensation Committee only during an open trading window period under our insider trading policy; |

|

| • | the grant date ordinarily is within five business days following the first day of the open trading window period, or such other date as the Compensation Committee determines; and |

|

| • | the exercise price (if applicable) for all equity awards is the closing price on the date of grant and stock options are granted with an exercise price of no less than the closing market price on the date of grant. |

grants made by the Compensation Committee occur only after discussion at a meeting of the Compensation Committee;

equity award grants ordinarily are made by the Compensation Committee only during an open trading window period under our insider trading policy;

the grant date ordinarily is within ten business days following the first day of the open trading window period, or such other date as the Compensation Committee determines; and

the exercise price (if applicable) for all equity awards is the closing price of our stock on the date of grant and stock options are granted with an exercise price of no less than the closing price of our stock on the grant date.

The Compensation Committee considers the aggregate equity usage by the Company compared to peer companies. Measures which are considedconsidered include total options and restricted stock units granted as a percentage of total shares issued and outstanding, total options and unvested restricted stock units outstanding as a percentage of total shares issued and outstanding, and total options and unvested restricted stock units outstanding plus shares available for future grant as a percentage of total shares issued and outstanding. In its 2013 assessment, Radford found that the one-year burn rate and the issued overhang rate for the Company in 2011 approximated the 25thpercentile of the named peer group.

28

Severance Benefits. The Compensation Committee believes that severance benefits are an important element of the executive compensation package,package. The severance benefits we offer assist us in recruiting and retaining talented individuals and our practices are consistent with the severance benefits offered by our peer practices.group. At the request of the Compensation Committee in 2013, Radford examinedprovided market-competitive executive severance benefit data for the termination benefits provided by the employment agreements then in effect withofficers, including the Named Executive Officers under a Company-initiated (not "for cause") and compared them to the benefits provided by the peer group. The severance benefits reviewed includedan executive-

initiated (for "good reason") employment termination provisions,following a change in control provisions,and absent a change in control. Competitive data was considered for prevalence, specific features, cash severance payments,and equity benefits, benefits continuation, change in control triggers, acceleration of equity awards non-competition and non-solicitation restrictions.excise tax treatment. Based upon this review, in 2008 the Compensation Committee approved new employment agreements forchanges to the Named Executive Officers summarized below in the section entitled “Employment Agreements.” The severance provisions of theour employment agreements, which are summarized below in the section entitled “Potentialtitled “Potential Payments Uponupon Termination or Change in Control.”

Retirement Savings Plan. Executive officers in the United States are eligible to participate in our 401(k) retirement plan on the same terms as all other U.S. employees. Our 401(k) retirement plan is a tax-qualified plan and therebytherefore is subject to certain Internal Revenue Code limitations on the dollar amounts of deferrals and Company contributions that can be made to plan accounts. These limitations apply to our more highly-compensated employees (including the Named Executive Officers). We made matching contributions at a rate of 50% of eligible contributions under the 401(k) retirement plan to our employees, including Named Executive Officers, thatwhich participate in the plan as set forth in the Summary Compensation Table. Our matching contributions are subject to a limit. Our executives outside of the United States participate in government-sponsored retirement programs. We do not maintain a supplementarysupplemental executive retirement plan (SERPs)(SERP) or a non-qualified deferred compensation plan for our executives or directors.

Other Compensation.Compensation and Personal Benefits. All of our executives are eligible to participate in our employee benefit plans, including medical, dental, life and disability insurance, vacation and employee stock purchase plans. These plans generally are available to all salaried employees and do not discriminate in favor of executive officers. Benefits are intended to be competitive with the overall market in order to facilitate attraction and retention of high-quality employees. Subject to local customs and the international nature of our business and management, it is generally our policy not to extend significant perquisites to our executives that are not generally available to our employees. In 2010, theThe Compensation Committee reviewed the executive perquisites in comparison to the peer group and made no changes.changes in any of 2013, 2012 or 2011. The Company provides Dr. Scherbakov with the use of an automobile, as it does to other high-ranking employees in Germany.

The Company purchases, from time to time, hourly use of an aircraft for the Chief Executive Officer and other executives for business travel integral to the performance of their duties. The Chief Executive Officer is encouraged to use the aircraft for efficiency, safety and security. The Compensation Committee adopted an aircraft use policy governing the use of the aircraft which the Company makes available to the executives. We permit only our Chief Executive Officer to use time on the aircraft for personal use only if he reimburses the Company for all costs related to personal use. There is no aircraft-related compensation in the Summary Compensation Table because unreimbursed use did not occur. We do not provide our executives with country club memberships, club dues or fees. Nor do we provide home security, tax preparation, estate planning or financial counseling.

Other Factors Affecting Compensation

Tax Deductibility Underunder Section 162(m). Section 162(m) of the Internal Revenue Code of 1986, as amended,(“Section 162(m)”), limits the deductibility for federal income tax purposes of certain compensation paid in any year by a publicly held corporation to its chief executive officer and its three other most highly compensated officers other than its chief financial officer to $1 million per executive (the “$1 million cap”). The $1 million cap does not apply to “performance-based” compensation as defined under Section 162(m). Historically, none of our executive officers has received annual compensation in an amount that would be subject to limitation under Section 162(m). [It is intended that stock option awards made under the Company’s 2006 Incentive Compensation Plan following the 2011 annual meeting of stockholders will qualify as “performance-based” compensation for purposes of Section 162(m). We believe we can continue to preserve related federal income tax deductions, although individual exceptions may arise. The Compensation Committee’s policy with respect to Section 162(m) is to consider the tax deductibility of awards as a factor in the compensation setting process and to generally make a reasonable effort to cause compensation to be deductible by the Company while simultaneously providing our executive officers with appropriate rewards for their performance. However, the Compensation Committee retains the discretion to provide compensation that may exceed the $1 million cap or not qualify for the performance-based compensation exception to Section 162(m).

Accounting Considerations. We consider the accounting implications of all aspects of its executive compensation program. In addition, accounting treatment is just one of many factors impacting plan design and pay determinations. Our executive compensation program is designed to attempt to achieve the most favorable accounting and tax treatment possible as long as doing so does not conflict with intended plan design or program objectives.

Advisory Vote on Executive Compensation

Say-on-Pay Advisory Votes. We conducted our first advisory vote on executive compensation at our 2011 annual meeting of stockholders. Then, our stockholders overwhelmingly approved our executive compensation structure in our first “say-on-pay” advisory vote, voting 40,928,468 shares (99.2%) in favor of our executive compensation structure compared to 305,747 shares (0.7%) against with 43,328 shares (0.1%) abstaining. Because a substantial majority of our stockholders approved the compensation program described in our 2011

proxy statement, the Compensation Committee did not implement changes to our executive compensation program in 2013 as a direct result of the stockholders’ advisory vote. At our stockholders meeting in 2011, the advisory proposal to hold “say-on-pay” advisory votes every three years received the greatest amount of votes. Accordingly, the “say-on-pay” advisory vote is being held at our 2014 annual meeting of stockholders. See the section below titled "Proposal 2: Advisory Vote on Executive Compensation."

In addition to the periodic advisory vote on executive compensation, we are committed to ongoing engagement with our stockholders on executive compensation and corporate governance issues. These engagement efforts take place throughout the year through meetings, telephone calls and correspondence involving our senior management and representatives of our stockholders. The Compensation Committee carefully considers feedback from our stockholders regarding our executive compensation program, including the results of our stockholders’ advisory vote on executive compensation. Stockholders are invited to express their views to the Compensation Committee as described in this proxy statement under the heading “Corporate Governance — Stockholder Communication with our Board of Directors.”

EXECUTIVE COMPENSATION TABLES

Summary Compensation Table

The following table sets forth information regarding compensation earned by our Chief Executive Officer, our Chief Financial Officer and our three other most highly compensated executives:executives for the fiscal years indicated below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Non-Equity

| | | | |

| | | | | | | | | Stock

| | Option

| | Incentive Plan

| | All Other

| | |

Name and Principal

| | | | Salary

| | Bonus

| | Awards

| | Awards

| | Compensation

| | Compensation

| | Total

|

Position | | Year | | ($)(1) | | ($)(2) | | ($)(3) | | ($)(3) | | ($)(2) | | ($)(4) | | ($) |

| |

| Valentin P. Gapontsev, Ph.D., | | | 2010 | | | | 393,735 | | | | — | | | | — | | | | — | | | | 512,682 | | | | 15,879 | | | | 922,295 | |

| Chief Executive Officer | | | 2009 | | | | 389,025 | | | | — | | | | — | | | | — | | | | — | | | | 62,579 | | | | 451,604 | |

| and Chairman of the Board(5) | | | 2008 | | | | 375,000 | | | | — | | | | — | | | | — | | | | 177,677 | | | | 66,407 | | | | 619,084 | |

| Timothy P.V. Mammen, | | | 2010 | | | | 295,000 | | | | — | | | | 69,213 | | | | 180,144 | | | | 295,000 | | | | 7,890 | | | | 849,247 | |

| Chief Financial Officer | | | 2009 | | | | 289,648 | | | | — | | | | — | | | | 147,831 | | | | — | | | | 6,140 | | | | 443,619 | |

| and Vice President | | | 2008 | | | | 279,814 | | | | 35,438 | | | | — | | | | 286,064 | | | | 52,933 | | | | 6,049 | | | | 660,671 | |

| Eugene Scherbakov, Ph.D., | | | 2010 | | | | 340,685 | | | | — | | | | 69,213 | | | | 180,144 | | | | 340,451 | | | | 33,220 | | | | 963,714 | |

| Managing Director of IPG | | | 2009 | | | | 351,437 | | | | — | | | | — | | | | 130,093 | | | | — | | | | 25,426 | | | | 506,956 | |

| Laser and Director(5) | | | 2008 | | | | 357,967 | | | | 45,171 | | | | — | | | | 252,064 | | | | 67,470 | | | | 27,238 | | | | 749,910 | |

| Angelo P. Lopresti, | | | 2010 | | | | 295,000 | | | | — | | | | 69,213 | | | | 180,144 | | | | 295,000 | | | | 8,160 | | | | 847,516 | |

| General Counsel, Secretary | | | 2009 | | | | 289,648 | | | | — | | | | — | | | | 118,265 | | | | — | | | | 6,140 | | | | 414,323 | |

| and Vice President | | | 2008 | | | | 279,814 | | | | 35,438 | | | | — | | | | 229,149 | | | | 52,923 | | | | 6,365 | | | | 603,689 | |

| Alexander Ovtchinnikov, Ph D., | | | 2010 | | | | 275,000 | | | | — | | | | 69,213 | | | | 180,144 | | | | 275,000 | | | | 7,897 | | | | 807,254 | |

| Vice President — Components | | | 2009 | | | | 269,512 | | | | — | | | | — | | | | 130,093 | | | | — | | | | 6,410 | | | | 406,015 | |

| | | | 2008 | | | | 248,723 | | | | 31,563 | | | | — | | | | 252,064 | | | | 46,989 | | | | 6,364 | | | | 585,703 | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Stock Awards ($)(1) | | Option Awards ($)(1) | | Non-Equity Incentive Plan Compensation ($)(2) | | All Other Compensation ($)(3) | | Total ($) |

Valentin P. Gapontsev, Ph.D.,

Chief Executive Officer and Chairman of the Board(4) | | 2013 | | 542,800 |

| | — |

| | — |

| | — |

| | 445,894 |

| | 11,125 |

| | 999,819 |

|

| 2012 | | 475,822 |

| | — |

| | — |

| | — |

| | 369,850 |

| | 12,345 |

| | 858,017 |

|

| 2011 | | 418,167 |

| | — |

| | — |

| | — |

| | 808,306 |

| | 16,261 |

| | 1,242,734 |

|

Timothy P.V. Mammen,

Chief Financial Officer and Senior Vice President | | 2013 | | 391,834 |

| | — |

| | 150,275 |

| | 432,302 |

| | 219,402 |

| | 8,190 |

| | 1,202,003 |

|

| 2012 | | 340,101 |

| | — |

| | 120,233 |

| | 353,768 |

| | 177,993 |

| | 8,040 |

| | 1,000,135 |

|

| 2011 | | 324,500 |

| | — |

| | 198,912 |

| | 511,080 |

| | 421,623 |

| | 7,890 |

| | 1,464,005 |

|

| Eugene Scherbakov, Ph.D., Managing Director of IPG Laser and Director(4) | | 2013 | | 432,777 |

| | — |

| | 132,242 |

| | 403,482 |

| | 246,462 |

| | 33,677 |

| | 1,248,640 |

|

| 2012 | | 364,382 |

| | — |

| | 120,233 |

| | 353,768 |

| | 195,609 |

| | 30,287 |

| | 1,064,279 |

|

| 2011 | | 376,187 |

| | — |

| | 176,602 |

| | 449,561 |

| | 488,452 |

| | 32,576 |

| | 1,523,378 |

|

Angelo P. Lopresti,

General Counsel, Secretary and Senior Vice President | | 2013 | | 373,980 |

| | — |

| | 120,220 |

| | 374,662 |

| | 209,404 |

| | 8,892 |

| | 1,087,158 |

|

| 2012 | | 324,606 |

| | — |

| | 112,608 |

| | 332,542 |

| | 169,883 |

| | 8,310 |

| | 947,949 |

|

| 2011 | | 309,750 |

| | 31,997 |

| | 176,602 |

| | 449,561 |

| | 402,458 |

| | 8,160 |

| | 1,378,528 |

|

Alexander Ovtchinnikov, Ph.D.,

Vice President —Components | | 2013 | | 363,600 |

| | — |

| | 108,198 |

| | 345,842 |

| | 203,593 |

| | 8,892 |

| | 1,030,125 |

|

| 2012 | | 302,452 |

| | — |

| | 112,608 |

| | 332,542 |

| | 158,286 |

| | 8,742 |

| | 914,630 |

|

| 2011 | | 288,750 |

| | — |

| | 176,602 |

| | 449,561 |

| | 375,173 |

| | 8,592 |

| | 1,298,678 |

|

| | |

| (1) | | The approved annual base salaries in 2009 were the same as 2010 (except for Dr. Ovtchinnikov). However the base salaries paid in 2009 were lower than in 2010 because all Named Executives Officers took voluntary salary reductions in 2009. |

|

(2) | | Represents amounts earned under our STIP for services rendered in 2010, 2009 and 2008, respectively. |

|

(3) | | Valuation based on the fair value of such award as of the grant date determined pursuant to ASC Topic 718. The assumptions that we used with respect to the valuation of restricted stock unit and stock option awards are set forth in Note 2 to our Consolidated Financial Statements in our Annual Report onForm 10-K filed with the SEC on March 15, 2011.February 28, 2014. |

| |

| (2) | Represents amounts earned under our STIP for services rendered in 2013, 2012 and 2011, respectively. |

| |

(4) | (3) | The amount in 20112013 for Dr. Gapontsev consists of (i) $11,125 in premiums paid for group term life insurance and (ii) $4,754 in health care premiums paid in Germany.insurance. Amounts for Messrs. Mammen and Lopresti and Dr. Ovtchinnikov include matching contributions to retirement accounts under our 401(k) plan and our payment of group term life insurance premiums. The amount for Dr. Scherbakov reflects the expense of an automobile provided by us. |

| |

(5)(4) | | Portions of the amounts paid to Dr. Gapontsev and Dr. Scherbakov were denominated in Euros and Rubles. These were translated into U.S. Dollars at the average daily exchange rates for 2010, 2009the full years. The average daily rates in 2013, 2012 and 2008,2011, for the Euro were 0.75, 0.78 and 0.72, respectively; and for the Ruble were 31.9, 31.17 and 29.29, respectively. As a result of compensation being paid in one or more currencies that fluctuate against the U.S. Dollar, the amount of salary paid may vary slightly from the salary stated in an employment agreement. |

Employment Agreements

We have employment agreements with each of the executives named in the table above. The employment agreements expire on December 31, 2011,2015, except for the employment agreement forwith Dr. Gapontsev, which expires on December 31, 2012.2016. Upon their future expirations, the employment agreements renew for terms of one year, unless the Company or a Named Executive Officer provides written notice of its or his intention to not renew the agreement not less than six months before the expiration date. In the event of a change in control, the agreements would be extended to expire on the second anniversary of suchthe change in control.

The employment agreements set the annual base salaries in 20102013 for the Named Executive Officers at $395,000as follows: $542,800 for Dr. Gapontsev, €257,000€325,850 for Dr. Scherbakov $295,000 for each of Messrs. Mammen and Lopresti and $275,000 for Dr. Ovtchinnikov. The salaries for 2011 are $414,000 for Dr. Gapontsev, €270,000 for Dr. Scherbakov, $324,500($432,544 at the 2013 average daily exchange rate), $391,834 for Mr. Mammen, $309,750$373,980 for Mr. Lopresti and $288,760$363,600 for Dr. Ovtchinnikov. For 2014, the Compensation Committee approved annual base salaries of $559,084 for Dr. Gapontsev, €335,626 for Dr. Scherbakov ($445,529 at the 2013 average daily exchange rate), $411,426 for Mr. Mammen, $385,199 for Mr. Lopresti and $374,508 for Dr. Ovtchinnikov. The agreements entitle these executive officers to participate in bonus plans, standard insurance plans such as life, short-term disability and long-term disability insurance and retirement benefits, such as the 401(k) plan and equity award plans described above, on similar terms and on a similar basis as such benefits are available

30

to executives at similar levels within the Company. Each of these executive officers also entered into a non-competitionseparate restrictive covenant agreement with the Company in 20082013 that prohibits each of them from competing with the Company for a period of one year after the termination of his employment with the Company for any reason and from hiring or attempting to hire the Company’s employees or soliciting customers or suppliers of the Company for a period ending eighteen months following the termination of his employment for any reason. Each of the officers is entitled to receive his base salary for the period during which the Company enforces the non-competition provisions of the agreement but not for more than one year following the termination of his employment. The severance provisions of the agreements are summarized below in the section titled “Potential“Potential Payments Uponupon Termination or Change in Control.”

Grants of Plan-Based Awards Table

The following table sets forth information regarding plan-based awards to our Named Executive Officers in 2010:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | All Other

| | | | |

| | | | | | | | | | | | | Option

| | | | |

| | | | | | | | | | | All Other

| | Awards:

| | | | Grant Date

|

| | | | | | | | | | | Stock Awards:

| | Number of

| | Exercise or

| | Fair Value of

|

| | | | | Estimated Possible Payouts Under

| | Number of

| | Securities

| | Base Price

| | Stock and

|

| | | | | Non-Equity Incentive Plan Awards

| | Shares of

| | Underlying

| | of Option

| | Option

|

| | | Grant

| | ($)(1) | | Stock or

| | Options

| | Awards

| | Awards

|

Name | | Date | | Threshold | | Target | | Maximum | | Units(#)(2) | | (#)(2) | | ($ / Sh) | | ($)(3) |

| |

| Valentin P. Gapontsev, Ph.D. | | | 2/23/2010 | | | | 55,547 | | | | 222,179 | | | | 512,682 | | | | — | | | | — | | | | — | | | | — | |

| Timothy P.V. Mammen | | | 2/23/2010 | | | | 27,656 | | | | 110,625 | | | | 295,000 | | | | — | | | | — | | | | | | | | — | |

| | | | 2/26/2010 | | | | — | | | | — | | | | — | | | | 4,375 | | | | — | | | | 15.82 | | | | 69,213 | |

| | | | 2/26/2010 | | | | — | | | | — | | | | — | | | | — | | | | 26,250 | | | | 15.82 | | | | 180,144 | |

| Eugene Scherbakov, Ph.D. | | | 2/23/2010 | | | | 42,281 | | | | 169,125 | | | | 340,451 | | | | — | | | | — | | | | — | | | | — | |

| | | | 2/26/2010 | | | | — | | | | — | | | | — | | | | 4,375 | | | | — | | | | 15.82 | | | | 69,213 | |

| | | | 2/26/2010 | | | | — | | | | — | | | | — | | | | — | | | | 26,250 | | | | 15.82 | | | | 180,144 | |

| Angelo P. Lopresti | | | 2/23/2010 | | | | 27,656 | | | | 110,625 | | | | 295,000 | | | | — | | | | — | | | | — | | | | — | |

| | | | 2/26/2010 | | | | — | | | | — | | | | — | | | | 4,375 | | | | — | | | | 15.82 | | | | 69,213 | |

| | | | 2/26/2010 | | | | — | | | | — | | | | — | | | | | | | | 26,250 | | | | 15.82 | | | | 180,144 | |

| Alexander Ovtchinnikov, Ph.D. | | | 2/23/2010 | | | | 25,781 | | | | 103,125 | | | | 275,000 | | | | — | | | | — | | | | — | | | | — | |

| | | | 2/26/2010 | | | | — | | | | — | | | | — | | | | 4,375 | | | | — | | | | 15.82 | | | | 69,213 | |

| | | | 2/26/2010 | | | | — | | | | — | | | | — | | | | — | | | | 26,250 | | | | 15.82 | | | | 180,144 | |

2013:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Grant Date | | Estimated Possible Payouts Under Non-Equity Incentive Plan Awards ($)(1) | | All Other Stock Awards: Number of Shares of Stock or Units(#)(2) | | Option Awards Number of Securities Underlying Options (#)(2) | | Exercise or Base Price of Option Awards ($ / Sh) | | Grant Date Fair Value of Stock and Option Awards ($)(3) |

| Name | | Threshold | | Target | | Maximum | |

| Valentin P. Gapontsev, Ph.D. | | 3/1/2013 | | 101,775 |

| | 407,100 |

| | 1,221,300 |

| | — |

| | — |

| | — |

| | — |

|

| Timothy P.V. Mammen | | 3/1/2013 | | 48,979 |

| | 195,917 |

| | 587,780 |

| | — |

| | — |

| | — |

| | — |

|

| | 3/1/2013 | | — |

| | — |

| | — |

| | 2,500 |

| | — |

| | — |

| | 150,275 |

|

| | 3/1/2013 | | — |

| | — |

| | — |

| | — |

| | 15,000 |

| | 60.11 |

| | 432,302 |

|

| Eugene Scherbakov, Ph.D. | | 3/1/2013 | | 54,068 |

| | 216,272 |

| | 648,848 |

| | — |

| | — |

| | — |

| | — |

|

| | 3/1/2013 | | — |

| | — |

| | — |

| | 2,200 |

| | — |

| | — |

| | 132,242 |

|

| | 3/1/2013 | | — |

| | — |

| | — |

| | — |

| | 14,000 |

| | 60.11 |

| | 403,482 |

|

| Angelo P. Lopresti | | 3/1/2013 | | 46,748 |

| | 186,990 |

| | 560,998 |

| | — |

| | — |

| | — |

| | — |

|

| | 3/1/2013 | | — |

| | — |

| | — |

| | 2,000 |

| | — |

| | — |

| | 120,220 |

|

| | 3/1/2013 | | — |

| | — |

| | — |

| | | | 13,000 |

| | 60.11 |

| | 374,662 |

|

| Alexander Ovtchinnikov, Ph.D. | | 3/1/2013 | | 45,450 |

| | 181,800 |

| | 545,427 |

| | — |

| | — |

| | — |

| | — |

|

| 3/1/2013 | | — |

| | — |

| | — |

| | 1,800 |

| | — |

| | — |

| | 108,198 |

|

| 3/1/2013 | | — |

| | — |

| | — |

| | — |

| | 12,000 |

| | 60.11 |

| | 345,842 |

|

| | |

| (1) | | Amounts shown represent potential amounts that were available under the STIP for 20102013 for achievement of financial performance measures. Themeasures, except that the possible payouts in the “Maximum” column represent the maximum permitted payout under the STIP in 2010. Performance measuresfor 2013 for both financial and individual performance measures. The performance goals used in determining STIP payments are discussed in “Compensationthe Compensation Discussion and Analysis”Analysis above. Actual amounts paid for 20102013 performance are shown in the “Non-Equity Incentive Plan Compensation” column in the Summary Compensation Table above. |

| |

| (2) | | The amounts listed reflect restricted stock units and stock options granted under our 2006 Incentive Compensation Plan and are described in the Outstanding Equity Awards Table below. |

| |

| (3) | | The value of an option award isValuation based onupon the fair value of such award as of the grant date determined pursuant to ASC Topic 718. The assumptions that we used with respect to the valuation of restricted stock unit and stock option awards are set forth in Note 2 to our Consolidated Financial Statements in our Annual Report onForm 10-K filed with the SEC on March 15, 2011.February 28, 2014. The option exercise price has not been deducted from the amounts indicated above. Regardless of the value placed on a restricted stock unit or stock option on the grant date, the actual value of the restricted stock unit or stock option will depend on the market value of our common stock at such date in the future when the restricted stock unit vests or the stock option is exercised. |

31

Outstanding Equity Awards Table

The following table provides information regarding unexercised stock options and unvested restricted stock units held by each of our Named Executive Officers as of December 31, 2010:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Number of

| | |

| | | | | Securities

| | Securities

| | | | | | Shares or

| | Market value

|

| | | | | Underlying

| | Underlying

| | | | | | Units of

| | of Shares or

|

| | | | | Unexercised

| | Unexercised

| | Option

| | Option

| | Stock That